Understanding INCOTERMS: Clarifying International Trade Responsibilities and Reducing Disputes

- July 15, 2024

- Blog

The import and export process requires expertise to ensure cost-effective, timely entry into the market, under conditions that conform to the terms agreed upon by the buyer and seller.

This INCOTERMS Manual is designed to aid your staff, to highlight the key issues involved in international import and export transactions and to raise their awareness of the required compliance with Customs legislation.

Inexperience in importing can result in unnecessary additional costs and may contribute to

shipment delivery delays.

Familiarity with the contents of this Procedures Manual, and consultation with 20Cube Logistics Pty Ltd staff, will help minimise such risks.

INCOTERMS

International trade is subject to the influence of varyious country laws, cultural practices

and the communication skills of the related parties.

In 1936 in an attempt to avoid, or at least reduce, disputes and litigation, the International

Chamber of Commerce published a set of international rules for interpreting trade

terms known as INCOTERMS (International Commerce Terms). Amendments to the original INCOTERMS have occurred as trade practices have changed. The current edition is INCOTERMS 2020.

INCOTERMS are three-letter acronyms that specify the allocation of responsibilities, costs, and risks between the buyer and seller during the shipment of international goods. Correct use of INCOTERMS must include a geographic reference and must always be set out as:

“[the chosen Incoterm rule], [named port/place/point] Incoterms® 2020

E.g., EXW Hamburg Incoterms 2020, FOB Hong Kong Incoterms 2020, DAP 2a/51 Alfred St, Fortitude Valley QLD 4006 Incoterms 2020. The location of the geographical reference will change depending on the term. Incoterms from previous years can be used but they must be specified in the contract e.g. EXW Sydney 1990.

Below is a brief description and list of the responsibilities of the parties under each type of

INCOTERM, blue elements refer to the seller, and orange elements refer to the buyer:

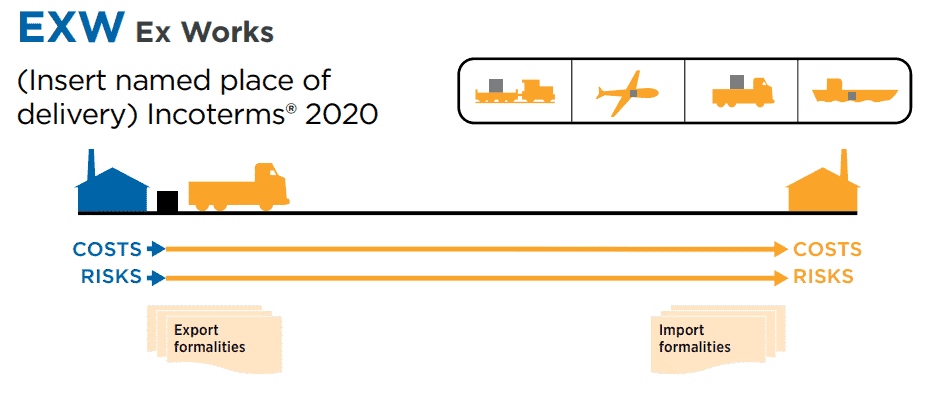

Ex Works (EXW)

“Ex-works” means that the seller fulfills their obligations to deliver when they have made the goods available at their premises (i.e., workshop, factory, warehouse, etc.) to the buyer. In particular, the seller is not responsible for the loading operations at their premises. The buyer is responsible for clearing the goods for export and insurance. The buyer bears all costs and risks involved in taking the goods from the seller’s premises to the destination. The seller has the least responsibilities with this term. This term should not be used when the buyer cannot carry out, directly or indirectly, the export formalities. In such circumstances, the FCA term should be used.

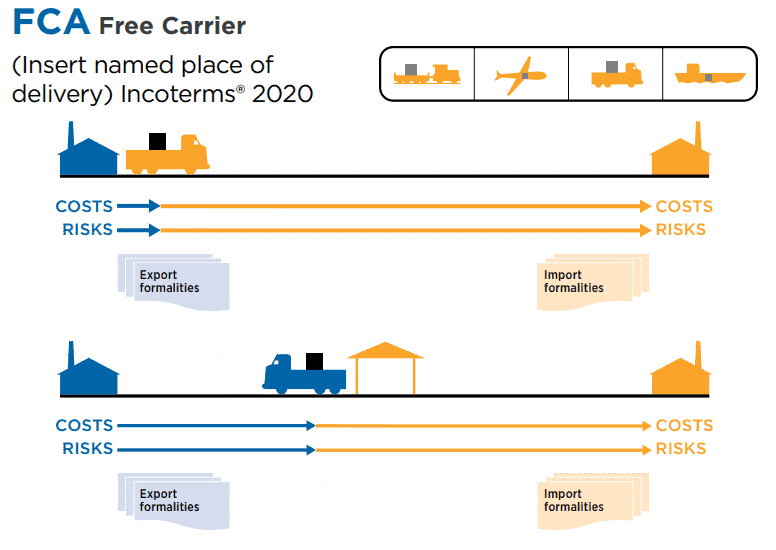

Free Carrier (FCA)

“Free Carrier” means that the seller fulfills their obligation to deliver one of two ways.

- If the named place is the seller’s factory/warehouse, the goods are delivered when they are loaded on the means of transport arranged by the buyer.

- If the named place is another place, the goods are delivered when having been loaded on the seller’s means of transport, reach the named place, and are ready for unloading from the seller’s transport at the disposal of the carrier.

If no precise point is indicated in the contract, the seller may select the point at the place of delivery that best suits their purpose.

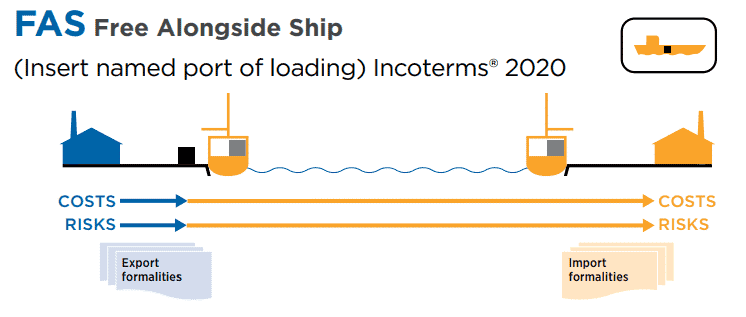

Free Alongside Ship (FAS)

“Free Alongside Ship” means that the seller fulfills their obligation to deliver when the goods have been placed alongside the vessel at the named port of shipment. This means that the buyer must bear all the costs and risks of loss or damage to the goods from that moment. The FAS term requires the seller to clear the goods for export. This term can only be used for sea or inland waterway transport.

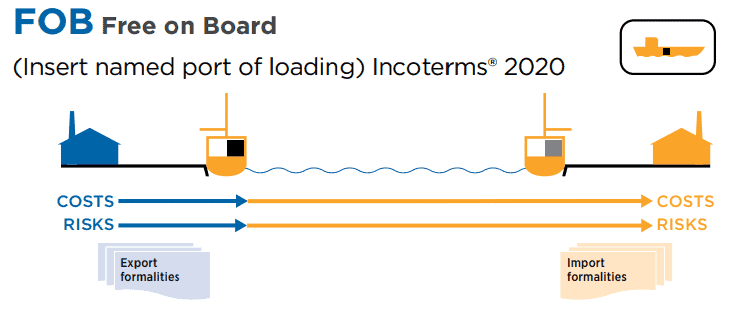

Free on Board (FOB)

“Free on Board” means that the seller fulfills his obligation to deliver when the goods have passed over the ship’s rail at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that point.

The FOB term requires the seller to clear the goods for export. The seller is also responsible for paying all loading costs and other charges payable before the FOB point to the extent that they are not included in the freight charges.

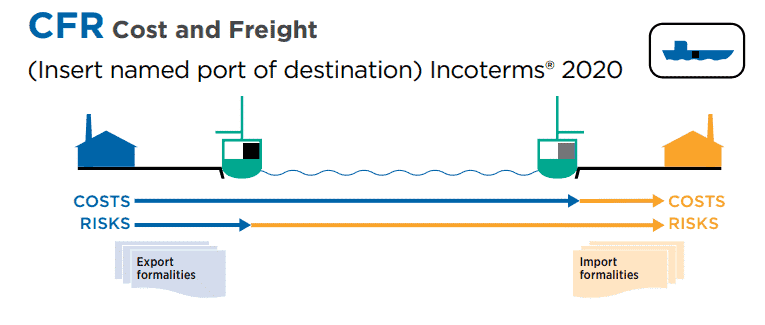

Cost and Freight (CFR)

“Cost and Freight” means that the seller must pay the costs and freight necessary to bring the goods to the named port of destination. The risk of loss or damage to the goods, as well as any additional costs due to events occurring after the time the goods have been delivered on board the vessel, is transferred from the seller to the buyer when the goods pass the ship’s rail in the port of shipment. As any risk falls on the buyer, so too does insurance. The CFR term requires the seller to clear the goods for export. The term can only be used for sea or inland waterway transport.

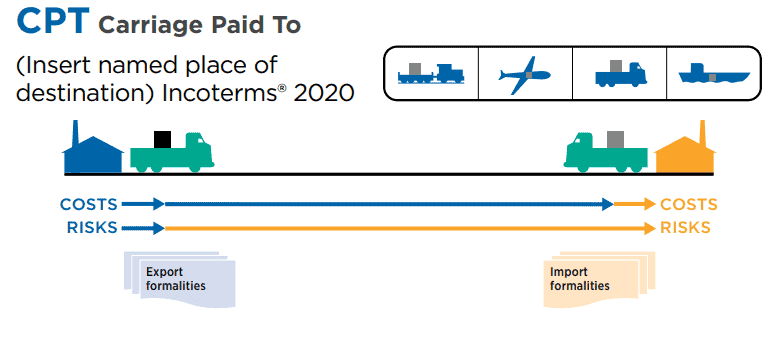

Carriage Paid to (CPT)

“Carriage Paid To” means that the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place and that the seller must contract for and pay the costs of the carriage necessary to bring the goods to the named place of destination. The seller fulfills its obligation to deliver when it hands the goods over to the carrier and not when the goods reach the place of destination. This term requires the seller to clear the goods for export, and unloading costs are for the buyer unless contracted otherwise.

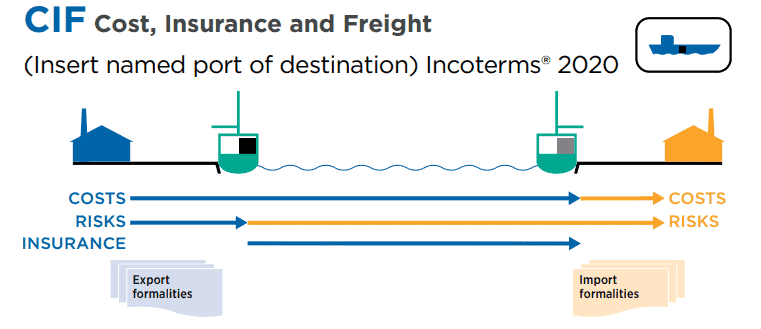

Cost, Insurance and Freight (CIF)

“Cost, Insurance and Freight” means that the seller has the same obligations as under CFR but with the addition that they have to produce marine insurance against the buyer’s risk of loss of or damage to the goods during the carriage. The seller contracts for insurance and pays the insurance premium. The buyer should note that under the CIF term, the seller is only required to obtain insurance on minimum coverage. The CIF term requires the seller to clear the goods for export. This term can only be used for sea or inland waterway transport.

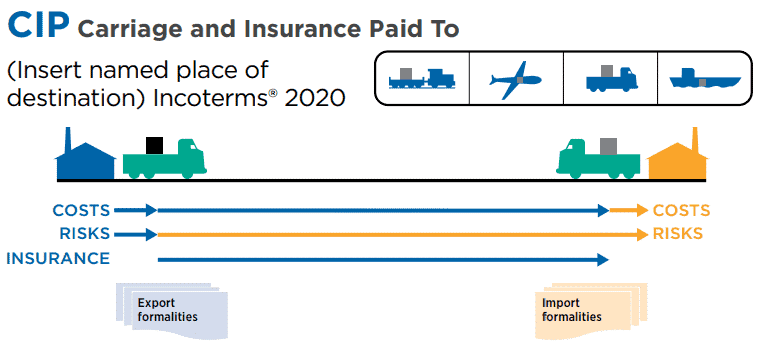

Carriage and Insurance Paid to (CIP)

“Carriage and Insurance Paid To” means that the seller delivers the goods to the carrier or another person nominated by the seller at an agreed place and that the seller must contract for and pay the costs of carriage necessary to bring the goods to the named place of destination. The seller also contracts for insurance cover against the buyer’s risk of loss or damage to the goods during the carriage. The buyer should note that under CIP, the seller is required to obtain insurance only on minimum cover.

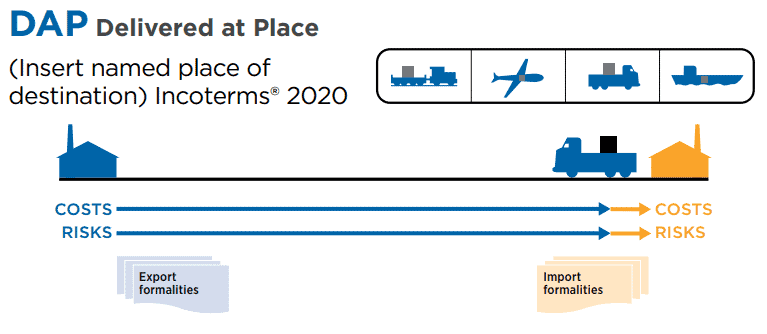

Delivered at Place (DAP)

“Delivered at Place” means that the seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. Buyer must pay all costs relating to the goods from the time they have been delivered, all costs of unloading necessary to take delivery of the goods from the arriving means of transport at the named place of destination, and the costs of customs formalities including duties and taxes.

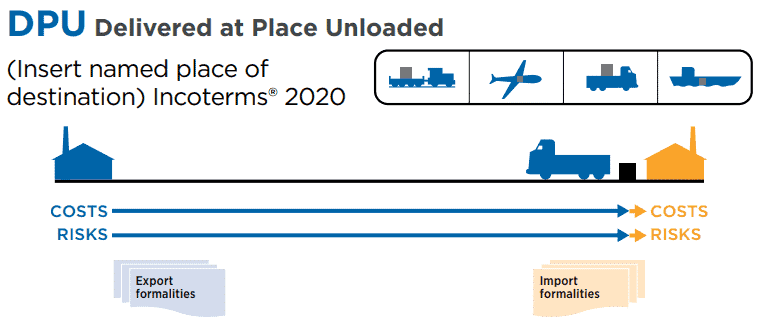

Delivered at Place Unloaded (DPU)

“Delivered at Place Unloaded” means that the seller delivers when the goods, once unloaded from the arriving means of transport, are placed at the disposal of the buyer at a named place of destination. The seller must pay all costs relating to the goods until they have been delivered, the cost of customs formalities necessary for export, duties, taxes, and other charges payable upon export, and the costs for their transport through any country.

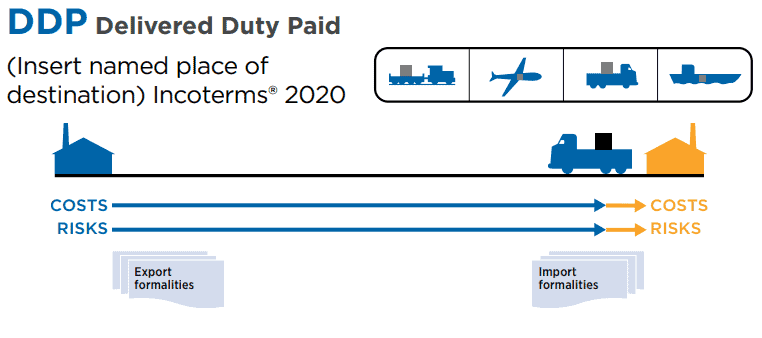

Delivery Duty Paid (DPP)

“Delivered Duty Paid” means that the seller delivers the goods to the buyer, cleared for import, and not unloaded from any arriving means of transport at the named place of destination. The seller has to bear all the costs and risks involved in bringing the goods thereto including, where applicable, any “duty” (which term includes the responsibility for and the risks of carrying out customs formalities and the payment of formalities, customs duties, taxes and other charges) for import in the country of destination.

However, if the parties wish to exclude from the seller’s obligations some of the costs payable upon import of the goods (such as value-added tax: GST, VAT), this should be made clear by adding explicit wording to this effect in the contract of sale. This term may be used irrespective of the mode of transport.

Conclusion

Understanding and correctly implementing INCOTERMS is crucial for smooth international trade operations. These standardised trade terms help prevent disputes, clarify responsibilities, and allocate costs and risks between buyers and sellers. By familiarising yourself with INCOTERMS 2020 and consulting with experts like 20Cube Logistics Pty Ltd, you can navigate the complexities of international trade more effectively, ensuring compliance and minimizing risks. Proper use of INCOTERMS facilitates better communication and smoother transactions and enhances your ability to compete in the global market.