How U.S. De Minimis Changes Will Affect Australian Trade

- August 22, 2025

- Blog

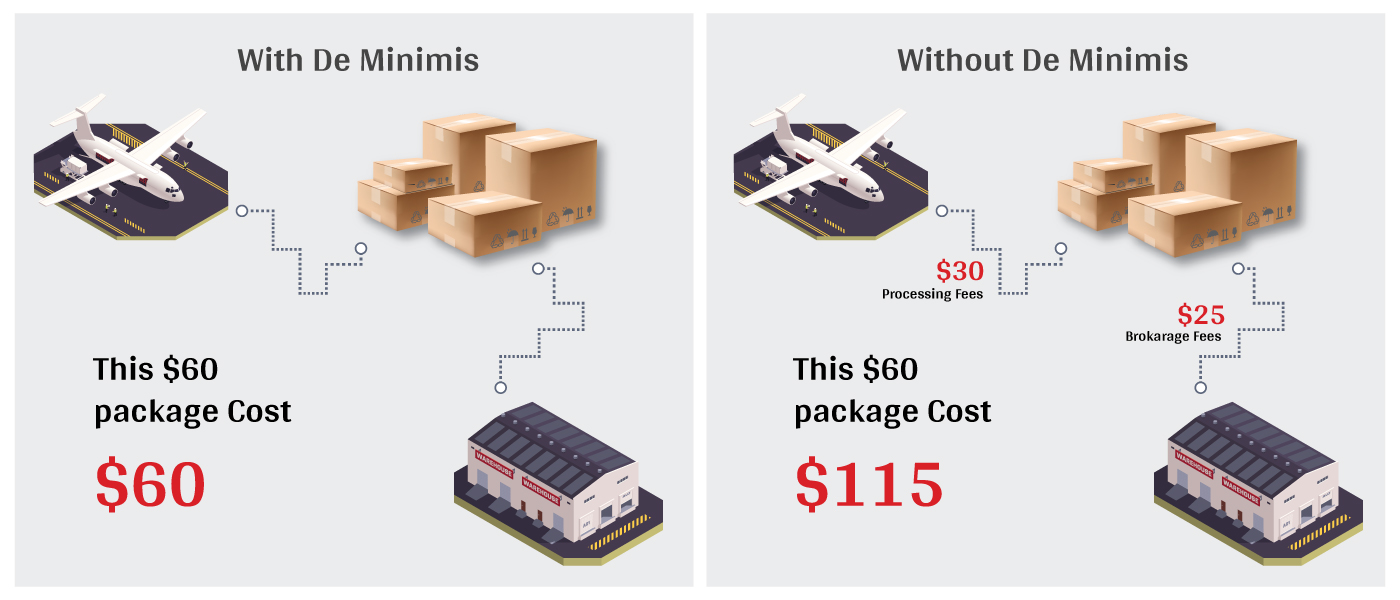

From this August 29, 2025, shopping from overseas will not only affect U.S. consumers but also have a direct impact on Australian exporters trading with the U.S., as the US is set to eliminate the $800 de minimis entry (i.e., duty-free entry of shipments of $800 or less into the United States).

This exemption has allowed low-value shipments to enter the US duty-free and with the least paperwork. Even though this change will help close loopholes in international trade, it will have a direct and instant impact on the prices you pay for shopping abroad.

Understaning De Minimis Rule

De Minimis is a customs limit that allows goods below a certain value enter a country without taxes, duties or full customs formalities. For the US, this limit has been $800 sine 2016. Due to this policy, consumer could easily buy directly from global sellers without worrying about any surcharge or import charges.

With this elimination from 29th Aug, 2025, each international purchase, irrespective of its value, will be exposed to full customs clearance and other applicable duties if importing into the US.

But why is it changing?

The US government states that the threshold has been exploited, with goods worth billions of dollars slipping into $800 limit leading to revenue loss.

What’s is in it for Australian exporters

Australia is one of the U.S.’s key trading partners, and many Australian businesses depend on smooth, low-cost access to the American market.

The end of de minimis will make it expensive for the U.S. to purchase goods from Australia, which until now had been duty-free or had negligible duties imposed due to the existence of Australia – US FTA.

While some Australian businesses might look for diversified markets like Asia or Europe, however the new tariffs will also lead to increase costs and potential delays. Companies will have to come up with pricing strategies and supply chain to stay competitive.

How 20Cube can help?

20Cube, with its digital engagement, can help keep you informed to keep your shipment simplified by:

- Real-time tax and duty calculation at checkout

- Landed cost insights

- Lower shipping cost thorough our digital network

- Smooth customs compliance to avoid delays and penalties

- And, a complete peace of mind